soxl stocktwits – Direxion Daily Semiconductor Bull 3X Shares is a leveraged ETF that aims to deliver three times the daily performance of the Philadelphia Semiconductor Index (SOX). It is a staple among the active trader and investor communities in all things tech, particularly those who like to trade or invest in semiconductors. The $SOXL ticker is the central hub of real-time conversations, market analysis, and investment information for this implementation product that is heavily controlled.

Table of Contents

About Soxl Direxion Daily Semiconductor Bull Company

SOXL is the semis sector 3X ETF. SOXL is a leveraged ETF, meaning that it will aim to magnify the daily returns of the index it follows (the semiconductor sector) and was created as a trading vehicle for the short term. SOXL looks to deliver 300% of the daily returns of the SOX Index, thus allowing traders magnify gains and losses.

Even firms that specialize in producing the chips, processors and such that everything from smartphones to data centers rely on compose a segment of the broader semiconductor industry. The semiconductor industry is an enabler for these kinds of technological advancements on a global scale, as the demand continues to rise in key areas like AI, cloud computing and 5G.

StockTwits Sentiment and Discussions

SOXL ticker can be used to join the conversation through StockTwits about how the ETF performs, where the market is going and what are the broader trends in semiconductor industry. Users share their views on:

Semiconductor news: As SOXL is semiconductor focused, reports from big names like Intel (INTC), NVIDIA (NVDA), AMD (AMD) and TSMC are talked about.

Trading ideas: Many StockTwits users trade SOXL and offer short-term price predictions, analysis on swing trades or day trades.

The optimism expressed on SOXL StockTwits is usually indicative of the overall market environment, with a few bullish traders who believe semiconductor stocks have the potential to quadruple, or similarly those that are skeptical, may advise against it.

Why SOXL Appeals to Traders

Trading-wise, SOXL remains a favorite because of the potential for it to put up nice numbers.He also said his desire was that “the classical and sports trainers would show respect and solidarity” towards the very challenging situation many Germans are in.”That means respecting decisions made by politicians regarding managing this crisis during these weeks when people want to regain normality,” Seifert added. Holding leveraged ETFs like SOXL long term are not recommended as the daily resets (which provide leverage to the fund) can result in decay which depletes the value of your investment over time. For day traders, however, SOXL does present an opportunity to capture intraday movements in the highly profitable semiconductor space.

The semiconductor sector has been on a tear over the past year, with growing demand for chips from the automotive industry and in areas such as telecommunications and artificial intelligence. Traders on StockTwits are talking about global chip shortages and the future of SOXL with consolidations in technologies like 5G and AI.

Risks and Volatility

SOXL has the potential for huge gains, but also could imply substantial risks. Being a leveraged ETF such as SOXL, it amplifies both gains and losses. This means if the semiconductor index drops by 1%, then SOXL might drop by say 3% and you can clearly see that this is a high risk investment.

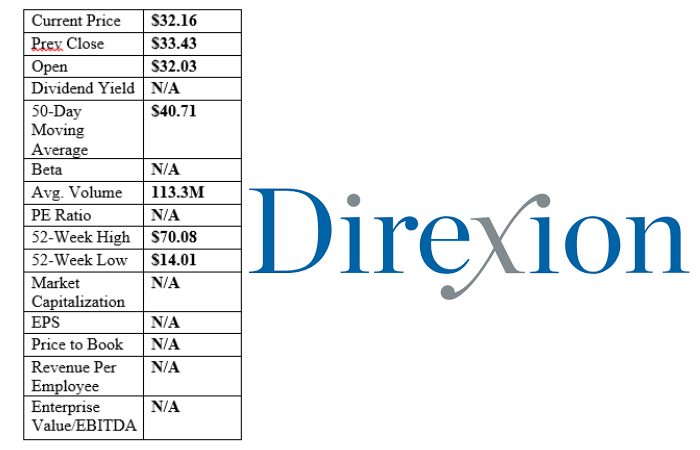

Soxl Stock Data

MARKET CAP: $113.3M

FLOAT: $1.54M

INDUSTRY: Investment Trusts or Mutual Funds

SECTOR: Miscellaneous

WEBSITE: https://www.direxion.com/product/daily-semiconductor-bull-bear-3x-etfs

COUNTRY: United States of America

CITY: New York, NY

Similar Companys

AB Ignitis Grupe [IGV]

First Trust Dow Jones Internet Index Fund [FDN]

Vanguard Information Technology Index Fund ETF Shares [VGT]

The Technology Select Sector SPDR Fund [XLK]

iShares U.S. Technology ETF [IYW]

AB Ignitis Grupe (IGV) Statistics & Alternative Data 2024

AB Ignitis grupe, through its subsidiaries, engages in the generation and distribution of electricity and heat. The firm operates through Green Generation, Networks, Reserve Capacities, and Customers & Solutions segments.

It also engages in the operation, surveillance and enhancement of renewable energy holdings including wind power; production of renewable electricity; operation of wind farms; development and operation of cogeneration power plant project; generation of electricity and heat from waste-fired plants; trading in electricity, natural gas and liquefied natural gas (LNG); as well as distribution, trade supply of natural gas. It serves buyers and sellers in Lithuania, Latvia, Poland, Finland, Estonia, and internationally. The company AB Ignitis grupe was established in 2008 and sits in Vilnius, Lithuania.

First Trust Dow Jones Internet Index Fund (FDN) Statistics & Alternative Data 2024

First Trust Dow Jones Internet Index Fund is an exchange traded index fund launched and managed by First Trust Advisors. The firm primarily invests in the public equity markets of United States. INZ000007832 AMFI Registration No. 70892. First Trust Dow Jones Internet Index Fund, formerly First Trust Exchange-Traded Fund, was formed on June 19, 2006 and is domiciled in United States.

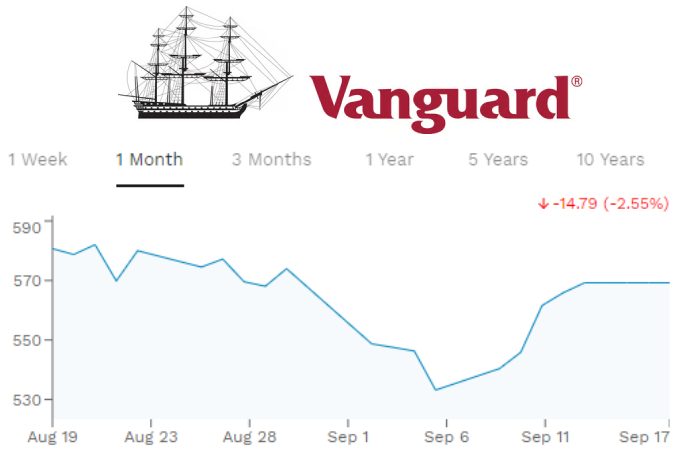

Vanguard Information Technology Index Fund ETF Shares (VGT) Statistics & Alternative Data 2024

Description Vanguard World Fund – Vanguard Information Technology ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. It invests in the public equity markets of the United States. It invests in the stocks of companies operating across the information technology sectors.

The fund mostly invests in growth and value stocks of companies across diversified market capitalization. The fund is designed to track the performance of the MSCI US Investable Market Index (IMI) / Information Technology 25/50, by employing full replication technique. This fund was launched on Jan 26, 2004 and is managed by Vanguard World Fund.

The Technology Select Sector SPDR Fund (XLK) Statistics & Alternative Data 2024

The Technology Select Sector SPDR Fund It is an exchange-traded fund launched by State Street Global Advisors, Inc. It is distributed by SSGA Funds Management, Inc. The fund primarily invests in the public equity markets of the United States. The fund invests largely in stocks of companies operating across information technology sectors.

The fund invests up to 65% of its net assets in growth and value stocks of companies that range across the market-cap spectrum. The fund simply seeks to track the performance of the Technology Select Sector Index with full replication. The Technology Select Sector SPDR Fund was launched June 22, 1998.

iShares U.S. Technology ETF (IYW) Statistics & Alternative Data 2024

Launched and managed by BlackRock, Inc., iShares U. S. Technology ETF The fund is managed by BlackRock Fund Advisors. The fund primarily invests in the public equity markets of the United States. It invests in the equities of companies that conduct business across information technology sectors.

The fund primarily invests in growth and value stocks of companies across diversified market capitalization. The fund employs representative sampling technique to track the performance of the Russell 1000 Technology Capped Index. The iShares U.S. Technology ETF was launched on May 15, 2000 and is a product of the USA.

Conclusion

SOXL StockTwits is an exciting place for traders and investors to share ideas, chart trends, and keep-up with the ever-changing semiconductor industry. SOXL is a leveraged ETF and, as such, should only be used by experienced traders who are looking to leverage their trades for short-term profit while trading in the semiconductor sector.

It comes with significant upside potential, but also increased risks and as such it is important for traders to stay sharp and adjust their strategies depending on the market conditions. StockTwits provides traders with up to the minute insights and opinions on how best to navigate the seemingly perilous waters of leveraged ETFs such as SOXL.