The bull flag is one among many technical indicators that traders use in the analysis of financial markets as they look for chances to foresee and capitalize on bullish breakouts. That’s the thing that distinguishes sophisticated market sentiment analysis and pattern forecasting from other forms of price activity or flag reading. Now let’s examine how to start online trading bull flags more closely, analyzing their meaning and consequences on investor behavior and market sentiment.

Table of Contents

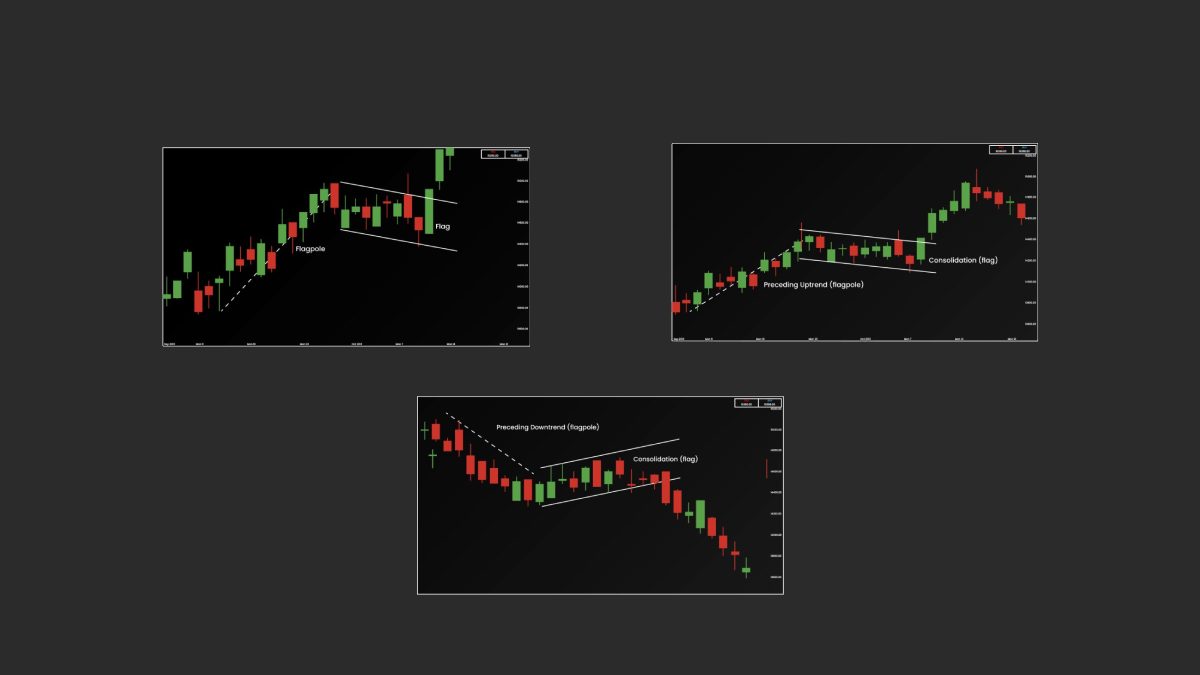

Decoding Bull Flags: Definition and Characteristics

Before jumping into the subject of whether or not bull flags are bullish or bearish as a first step, you need to know what the bull flag structure is. A bull flag is a consolidation pattern that normally occurs throughout an extended uptrend, and which is usually regarded as a pause where the price is moving sideways after an acceleration phase of a general appreciation. This consolidation period usually occurs in the form of either a contraction in momentum or a narrow trading range of prices, allowing the development of a flag-like structure on the price chart. Bull flags once again show up as a bullish signal since they suggest that a momentary stop of the northward movement might be followed by a return to the same after a pause.

Bullish Signals: Strength and Confirmation

On a superficial level, a bull flag is interpreted as a bullish signal warranted due to the pro-bullish association of a bull flag with a favorable ascending prices movement. But the congeniality of a bull flag can only be guaranteed under certain conditions such as; the nature of such a flag and the confirmation signals provided by the technical indicators. Even if a bull flag appears in the framework of a rally and appears like a strong bullish continuation pattern, traders should be careful and need to hunt for additional confirmation signals for confirmation of the bullish bias. The buyers confirm their presence with beams like bullish candlesticks patterns, increased trading volumes before the flagpole which is part of the flag pattern, or a breakout above the flag pattern’s upper resistance trend line.

Bearish Considerations: Potential Pitfalls and False Breakouts

Although, in their positive connotations, these bull flags will most of the time frustrate your expectations by changing direction on you or even misrepresenting you to another bearish reversal, especially in times of high market volatility or unpredictability. Traders are asked to remain cautious of the possibility of bearish outcomes and keep their eyes on bullish signals. The false breakouts, that is, the instances where the price for only a short period surpasses the upper resistance of the trend line of the flag pattern before it again starts to decline, are quite regular in the case of bull imitation patterns. Along with that, market conditions may be weakened, negative news events may take place, or if for some reason the investor sentiment goes into a bearish mood, this may invalidate the bullish view of the bull flag and will make the trend not bullish, but instead the trend will become bearish.

Market Context and Sentiment: Macroscopic Analysis

To carefully evaluate the bullish or bearish connotations of a bull flag, traders need to acknowledge a wider market view and overall sentiment. A bull flag developing inside a strong, reliable price increase and throughout the time of positive market fundamentals accompanied by supportive economic data is expected to lead to a bullish trend. On the contrary, a bull flag presenting at a point of market weakness or overextension, where factors such as waning investor confidence, negative news flow and upcoming economic adjustments influence the market adversely, can indicate higher possible bear reversal. Traders should determine their analysis, according to macroeconomic indicators, geopolitical events, and central bank policies when interpreting bull flag patterns or doing trading.

Risk Management and Trade Execution: Mitigating Risks

Despite the presence of a bulls and bears bias of bull flag pattern trading outcomes, it is important to use proper risk management techniques for trading.

Risk management has always been an integral part of any trading strategy and during volatile market conditions, it is crucial to avoid excessive trading when prices are rising and to have exit strategies prepared to prevent major losses in the event of further price falls. Achieving that might include putting the stop-loss at different levels below the support line in the flag pattern’s trendline to limit the exposure to losses. Find the correctly given sentence and modify it to get the intended output. Also, traders must follow the rules on psychologically disciplined trade conduct, which includes limiting entry and stop orders, proper position sizing, and avoiding all emotional getting involved.

Setting Stop-Loss Orders: Defining Risk Tolerance

Risk management tools such as stop-loss orders could be one of the most effective methods of minimizing dangers for traders through the development of a system in which risk tolerance is identified and the height of losses is well-known. A stop-loss buy order below the key support level or the lower boundary of the flag formation would limit the risks of the loss that might occur with the price movement to the north. More specifically, stop losses help traders keep their positions from falling to a significant drawdown limit while keeping in line with prudent risk-taking guidelines.

Technical Analysis and Price Action: Fine-Tuning Trading Strategies

Concessions of technical analysis and price action strategies may enhance the knowledge of this indicator and the bullish and bearish movements of the pattern. An expert trader might be using a set of technical tools to confirm uptrends and further trend reversals. Also, being cautious with the technical pricing actions, for instance; breaking the trendlines, studying the volume patterns, and using candlestick formations to unveil the patterns, would aid traders to make better decisions and increase their revenues.

Conclusion

In summary, even though bull flags are typically linked to bullish continuation patterns, there are nuances to how they should be interpreted about investor behavior and market sentiment. For traders to effectively assess whether a bull flag pattern is bearish or bullish, they need to carefully examine the surrounding market conditions, confirming signs, and mood. By exercising caution, using effective risk management measures, and combining technical analysis tools, traders can navigate bull flag formations with confidence and capitalize on prospective trading opportunities while reducing downside risks.