bbbyq stocktwits: Bed Bath & Beyond was an American big-box retail store chain specializing in housewares, furniture and specialty items. The chain was both a member of the Fortune 500 and the Forbes Global 2000 lists, headquartered in Union, New Jersey with locations all over North America — now no longer including Gingiss Brothers with Overstock Company assuring that at Bankrupcy

Table of Contents

Bed Bath & Beyond details

An empty shopping cart is seen outside a Bed Bath & Beyond Inc., store in Bowling Green, Kentucky, U.S. On Monday December 7,2020 the battered home goods business announced it had filed confidentially for Chapter 11 bankruptcy protection and reached an agreement with lenders to cut its debt load another example of how retailers further weakened by the pandemic are being forced into painful restructurings as they move to claw their way back from shutdowns tied illness. Following a bankruptcy, the stock was delisted from big exchanges such as NASDAQ and then moved to the over-the-counter (OTC) market under “BBBYQ”. This transition usually occurs to businesses undergoing a major restructure or in the midst of liquidation.

StockTwits and BBBYQ StockTwits is a free financial social media platform designed for investing in stocks, cryptocurrencies.. Whether you are a current holder or want to invest in BBBY shares, the StockTwits feed is where everyone discusses their thoughts and ideas about that stock.

No other stock has seen as much chatter and coverage on StockTwits as the former retail giant, due to its troubled times at present combined with how BJ shares have yo-yoed in price since emerging from bankruptcy court. StockTwits users often share their views, technical analysis rumors and speculation on the company’s future that would inevitably have an effect (hopefully) in Share Price.

What Will Appear on The BBBYQ StockTwits Feed

- Live Market Sentiment: People talk about the sentiments connected to BBBYQ on StockTwits regularly. This includes whether or not users are bullish (believe the stock is going to rise) of bearish (expect it to fall). These insights give a quick gauge of investor feelings and knee-jerk reactions to news or earnings reports.

- News and Updates: Follow the BBBYQ StockTwits feed for up-to-the-minute news of upcoming Bed Bath & Beyond bankruptcy hearings, its restructuring plans (such as they are), any legal developments. This means it is critical for possible investors to follow any pertinent news since the stock ceased trading on a traditional exchange and moved into OTC markets.

- Speculation and Rumors: Stocktwits.com is full of people that like to share speculative information and rumors, some are true while the rest remains uncleared. With BBBYQ, the discussion turns back to whether there might be some bids for acquisition and/or what liquidation values or court decisions may yield.

- StockTwits analyze: of the price action in BBBYQ combined with their predictive suggestions. You can expect HTB discussions around support and resistance levels, moving averages (20dip 50dp perpendicular to a planet display trending nature or key pivot points among the likely toys for our serum), low volume denotes typical toy behavior until high short exceeds over Days and Short % classified are big on visuals will always be BEHIND price.

- Community Interaction: StockTwits is famous for its big, active community. Lively debates, conversations and insights of various retail investors on how the stock will perform next can be found in BBBYQ feed.

Key Developments

Buy: Overstock In the bankruptcy proceedings, Bed Bath & Beyond’s intellectual property and digital assets were acquired by 1-800 Flower.Com for $21.5 million The franchise precedes that is: brand name, customer database & online platforms but not actual stores and inventory.

Model Program: The acquisition was declared in the year 2021 and comes to pass with the brand relaunch of Overstock as it joins Bed Bath & Beyond under one operational model. The launch features website & loyalty program, which hope to tap an appeal with customers of the brand Bed Bath & Beyond’s.

Market Action: Shares of Overstock rallied following the announcement, before sharply selling off; now trading near YTD lows. And whether or not the new Bed Bath & Beyond will excite investors as much maybe even more than the original brand once did during its heyday.

Consumer Sentiment: Overstock CEO Patrick Byrne is quite optimistic about the various synergies across two brands, as he sees that combining Asset Light model of Over took with brand loyalty of Bed Bath & Beyond may significantly boost market share. Still, analysts say they are cautious: They argued that the mismanagement of Bed Bath & Beyond in past years could be a long shadow over future gains.

Tough Path: Overstock deals with its own challenges, such as tough competitions and lower revenues. Will the new Bed Bath & Beyond can be successful in retail landscape or will come down as the key is to has put integration and rebranding at its heart

Reasons to Avoid Stock Investing in BBBYQ, like most post-bankruptcy company stocks, is on the speculative side. The OTC market is generally less liquid and more volatile than stocks that are traded on a stock exchange. There is also a risk of liquidation which would leave common stock holders with minimal or $0 value. As a result, investors must pay attention to names like this rather establish due diligence.

Overstock. Com, Inc. announced it secured the purchase of certain intellectual property assets from Bed Bath & Beyond under a Bankruptcy Court approved process.

Similar Companys

Wayfair Inc [W]

Kohl’s Corp. [KSS]

Home Depot Inc [HD]

Best Buy Co.Inc [BBY]

Big Lots Inc [BIGGQ]

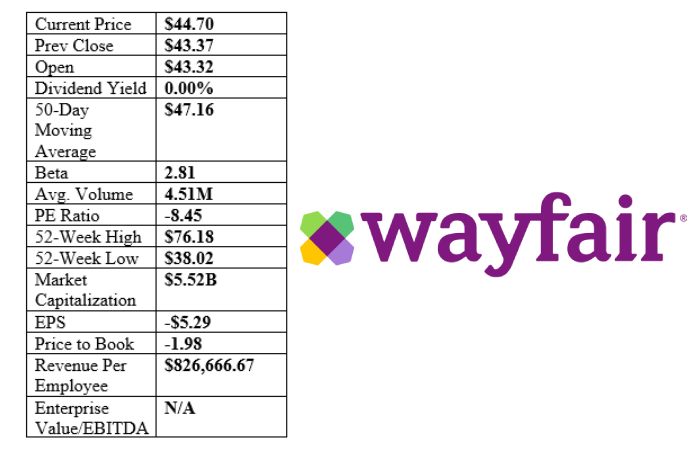

Wayfair Inc (W) Statistics & Alternative Data 2024

Wayfair, Inc. operates an online home furnishing store. It operates through U.S. and International segments. The U.S. segment has amounts earned through product sales through the company’s five distinct sites in the U.S. and through websites operated by third parties in the U.S. The International segment has earnings through product sales in international sites. The company is founded by Steven K. Conine and Niraj S. Shah on May 3, 2002, and is headquartered in Boston, MA.

Kohl’s Corp. (KSS) Statistics & Alternative Data 2024

Kohl’s Corp. engages in the operation of family-oriented department stores. Its business line includes apparel, footwear, and accessories for women, men, and children, home products, beauty products, and accessories. The stores generally carry a consistent merchandise assortment with some differences due to regional preferences. The company is founded in 1962 and is headquartered in Menomonee Falls, WI.

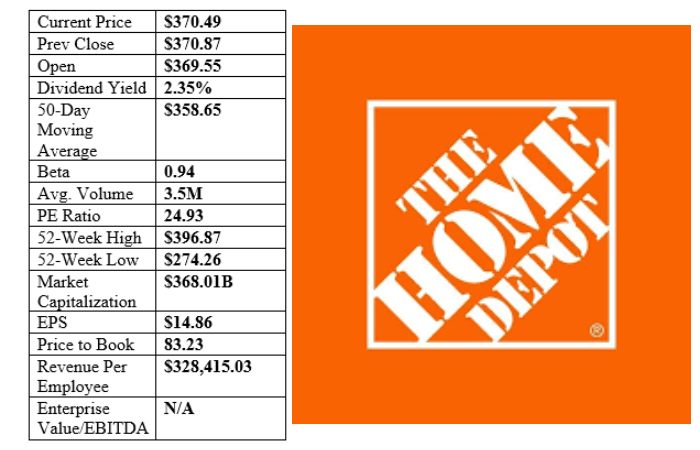

Home Depot Inc (HD) Statistics & Alternative Data 2024

The Home Depot, Inc. sells building materials and home improvement products. Its products include building materials, home improvement products, lawn and garden products, and decor products. The company operates through the following geographical segments: U.S., Canada, and Mexico. The company offers home improvement installation services, and tool and equipment rental. The company is founded by Bernard Marcus, Arthur M. Blank, Kenneth Gerald Langone, and Pat Farrah on June 29, 1978, and is headquartered in Atlanta, GA.

Best Buy Co. Inc (BBY) Statistics & Alternative Data 2024

Best Buy Co, Inc. provides consumer technology products and services. The company has two business segments: Domestic and International. The Domestic segment has all store, call center and online operations within the U.S. operating under various brand names including but not limited to Best Buy (bestbuy.com), best buy Mobile, Geek Squad, Magnolia Audio Video, Napster & Pacific Sales.

International (Australia, Austria, Belgium and France by the end of Q3 2018) – Includes all operations located outside U.S. and its territories including Canada, Europe, China, Mexico, Turkey It also sells products through the brand names: Best Buy, bestbuy. com, Best Buy Direct, Best Buy Express and Geek Squad; U.S. Cellular; Magnolia Audio Video location within a Best Buy store without the use of ground transportation at distribution centers) · Other: Business Revolving Credit Cards (non-consumer accounts). It was founded by Richard M. Schulz in 1966 and is headquartered at Richfield, MN.

Big Lots Inc (BIGGQ) Statistics & Alternative Data 2024

Big Lots, Inc. are traded on the New York Stock Exchange as a publicly listed company It operates through the Discount Retailing segment. Discount Retailing, which encompasses furniture and home merchandise (seasonal, soft home), food (including consumables), hardlines & electronics; toy & accessories. Sol A. Shenk founded the company in 1967 and is headquartered in Columbus, OH.

Conclusion

The BBBYQ StockTwits stream is a fun platform where you can read stock news, analysis and commentary on what Bed Bath & Beyond become during the bankruptcy process. StockTwits is great for information, but be careful as many posts are speculative or rumors. BBBY20QQ filings serve as another reminder that due diligence in regards to bankruptcy are mandatory before deciding to hike BBBYQ or any other OTC stock.

In general, there is hope about operating integration with Overstock and rebranding Bed Bath & Beyond. com Despite laws such as the Paycheck Fairness Act and their prior experience in winning Wall St. equal pay, Media Matters has found that challenges persist. The world will be watching to see how this plays out, especially with the consumer and on a financial basis.