Table of Contents

MICR Definition

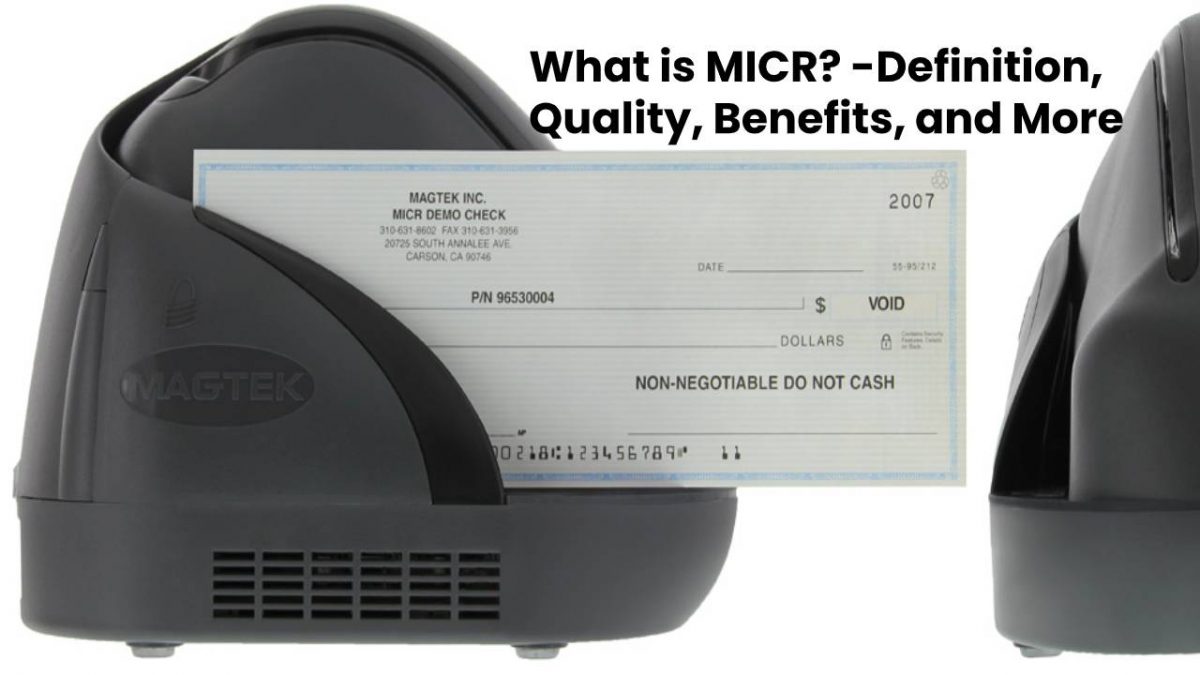

Magnetic ink character recognition code, known as MICR, is a character-recognition technology used mainly by the banking industry.

And also, to streamline the processing and clearance of checks and other documents through the FEDERAL RESERVE BANKS.

It check printing solutions adhere to the ANSI X.9 document preparation standards that govern the quality of the printed check document.

How does MICR Works?

The MICR mainly used by the banking industry. The two fonts that used worldwide are E-13B and CMC-7.

The benefit of MICR over other computer-readable information such as bar codes is that humans can read MICR numbers.

These unique fonts used to help computers recognize the characters and limit check fraud.

It allows the computer to rapidly affect a check number, account number, and other information from printed documents, such as a personal check.

The MICR number sometimes confused with the account number, written with magnetic ink, usually in one of two primary fonts.

What are the benefits of [MICR]?

Firstly, It has its ability to facilitate the use of routing numbers quickly.

A routing number is a specific nine-digit numerical code for banking and other financial institutions.

They use for clearing funds and processing checks in the U.S. As it appears on the front of a test.

The routing number signifies the bank that holds the account to draw the funds.

And also, Wire transfer and direct deposits often rely on routing numbers.

What is the quality of [MICR]?

MICR Toner

It contains iron oxide that adds the magnetic properties to each character, enabling rapid check clearing through high-capacity reader-sort machines.

MICR Fonts

These are the characters that appear at the bottom of checks or financial documents.

There are two different fonts they use, E-13B or CMC-7, depending on the banking standards of a country.

And also, The e-13B font is the banking standard for the United States.