chpt stocktwits – ChargePoint Holdings, Inc. provides electric vehicle charging network services. It develops, designs and markets electric vehicle charging system infrastructure networked solutions and provides Cloud Services that allow (CSPs) to locate, reserve, authenticate and transact EV charging sessions.

The company said it offers an open framework that serves up charging session data in real time and networked charging systems can be controlled, managed or supported. It provides several web portals as part of the network of charging system owners, fleet managers, drivers and utilities. It was founded in 2007 and is based in Campbell, California.

Table of Contents

About Chpt ChargePoint Holdings Company

One such name is ChargePoint Holdings Inc. (CHPT) in the electric vehicle (EV) charging infrastructure space. As the EV market continues to expand, ChargePoint has emerged as one of the leading players in this space by offering fully integrated charging options for home and commercial use. You can also find CHPT discussed on StockTwits, one popular social media platform focused on traders and investors in order to get additional Intel, market sentiment, and analysis for the future of EV charging.

What Is ChargePoint (CHPT)?

One of the largest, worldwide, you have ChargePoint. As the need for electric chargers grows due to a worldwide effort in advancing green energy and reducing carbon emissions, ChargePoint is also benefitting from that tailwind. He has made a promise to create the infrastructure that is needed for electric vehicles line as he plans on putting up charging stations everywhere in public, private and fleet domains. HardwareSales, SoftwareServices & Subscriptions. The revenue model of ChargePoint makes us realize their multiple tappable opportunities in the market directly from day one.

StockTwits Community and Market Sentiment

Investors and traders alike congregate on StockTwits around the CHPT ticker, including both long-term bulls invested in what they feel is a stock with substantial growth potential, as well as short-term traders betting on price movements.

Analyst coverage & sentiment score: Traders frequently report on trends for the price of ChargePoint stock, and provide short-term price targets, moving averages, support, resistance levels etc.

ChargePoint earnings reports: Every earning season the company’s financial performance is often discussed. Of course, investors pore over quarterly earnings results, pouring through the data to get a good idea of how well a company is growing revenues, how profitable it is and what kind of expansion plans might be in store. That in turn feeds future price predictions and investment strategy.

Electric Vehicle Big Picture: ChargePoint is inextricably linked to EV While electric vehicles are still a relatively small portion of the total addressable market for CHPT stock, any announcements impacting what will ultimately be a massive space will generate headlines. StockTwits Investors talk about EV manufacturers such as Tesla, Rivian and Lucid Motors and government policies, regulations or incentives that ultimately could promote the adoption of an electric vehicle and charging infrastructure.

Growth Potential

On StockTwits, a lot of investors are positive about what lies ahead for ChargePoint; Bulls are often driven by the strong positioning within the EV infrastructure market, which is poised to grow tremendously as more countries charge towards electrification and reduction in greenhouse gas emissions.

For their part, governments around the world are making similar commitments to creating the infrastructure for EVs, in many cases investing heavily in both clean energy and charging. ChargePoint could also be a beneficiary of the Biden Administration’s focus on electric vehicles and renewable energy in the U.S., which further cements its view for growth.

ChargePoint’s strategic partnerships and global expansion are also explored by the StockTwits community. ChargePoint is a global EV charging leader (with a presence both in North America and Europe), which makes it an attractive long-term investment opportunity.

Risks and Concerns

Profitability concerns: ChargePoint is losing money because it’s still building out its network, so the IPO doesn’t instantly resolve ChargePoint’s profitability woes. Therefore, the profitability problem persists for some investors. With strong revenue growth this is something many traders want to make sure the company can do consistently,Turning a profit.

Market competition: The EV charging market is quite competitive already and this is an area we are seeing a lot more action in. Segment leaders like Tesla (with their well known Supercharger network) and Blink Charging (BLNK) continue to expand while others are moving into the business,new players will need deep pockets or alliances with one the segment leaders to go head-to-head with them.

ChargingPoint stock volatility: Stocks like this can be volatile, & ChargePoint’s stock price known to rise and fall in the market sentiments or macroeconomic conditions about EV industry. The other traders on StockTwits chase after these short-term price movements, the longer term holders are thinking more about the fundamentals and what is growing.

Community Input and Tactics

StockTwits: Whether they were not informed or someone posted before them, it seems that professional traders come for their trade idea from StockTwits.

Technical Indicators: Current analysis of swing-trader recommendations on about how to take advantage of technical indicators is that only respond to shortsighted price moves, but it may give you an insight with more focused goals like trend validation or short-term prediction for CHPT Stock price trends based solely on new information.

Lockboxes: Long-term investors in ChargePoint and proponents of the future of EVs and clean energy have been arguing their case for some time now and pointing to what they view as positive signs. They also maintain that creating an EV infrastructure is essential for an overall transition to cleaner transportation.

Market Sentiment Polls: Using polls or voting how you would buy, sell, or hold CHPT stock in StockTwits will also give you an idea of what other traders are feeling about the markets. So, this gives an information of the attitude of community towards stock.

Chpt Stock Data

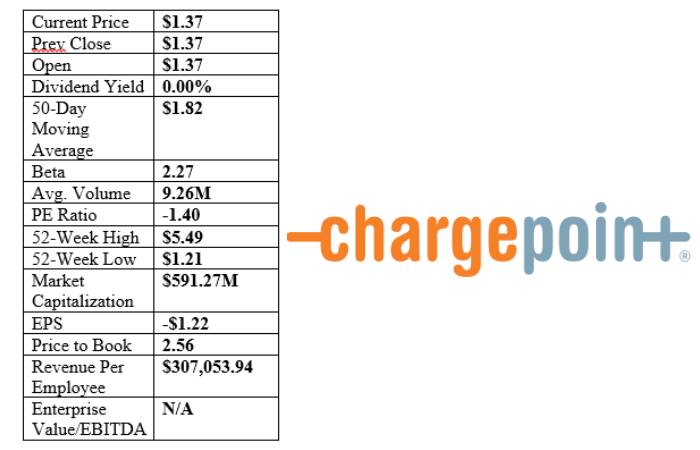

MARKET CAP: $591.27M

FLOAT: $9.26M

INDUSTRY: Specialty Stores

SECTOR: Retail Trade

WEBSITE: https://www.chargepoint.com/

COUNTRY: United States of America

CITY: Campbell, CA

Similar Companies

EVgo Inc [EVGO]

Blink Charging Co [BLNK]

Wallbox NV [WBX]

Naas Technology Inc [NAAS]

Ads-Tec Energy PLC [ADSE]

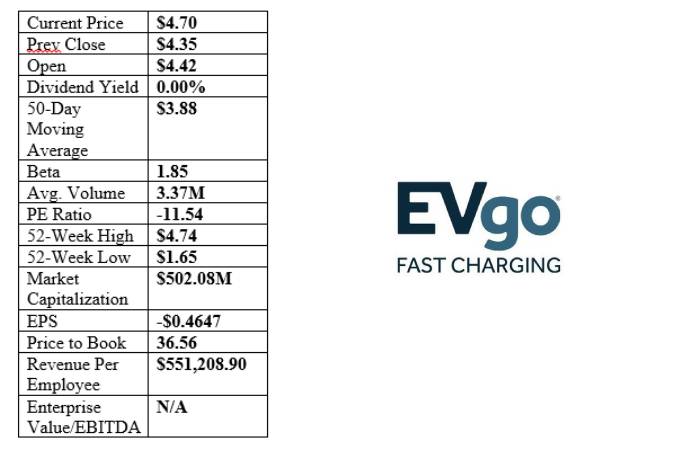

EVgo Inc (EVGO) Statistics & Alternative Data 2024

EVgo, Inc. engages in electric vehicle charging station services. For instance, it provides the EVgo network home charging solutions work charging solutions freedom station plans for electric car owners. It was founded in October, 2010 and is headquartered in Los Angeles, CA.

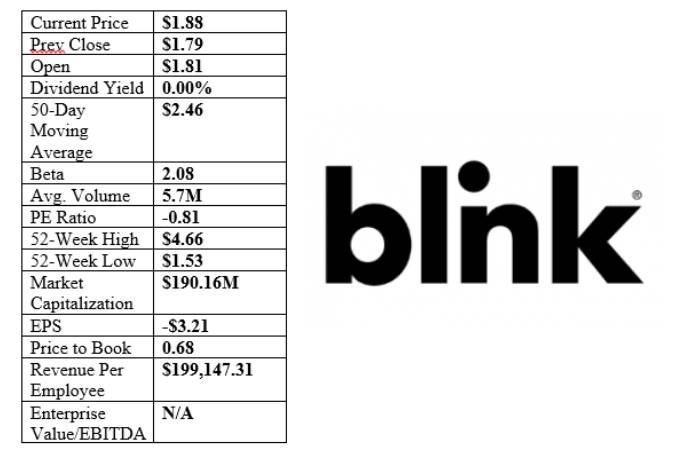

Blink Charging Co (BLNK) Statistics & Alternative Data 2024

Blink Charging Co. is one of the leaders in nationwide public electric vehicle charging equipment and services, enabling EV drivers to easily charge at locations throughout the United States.

It offers automated electric vehicle (EV) charging hardware and software services the Blink EV charging network (the Network, an associated cloud-based dashboard), additional legacy home charger products and installation services, also known as Electric Vehicle supply equipment (EVSE); and turn-key EV service solutions to commercial fleets. It uses ParaFuel software and was founded by Michael D. Farkas on October 3, 2006 and is headquartered in Bowie, MD.

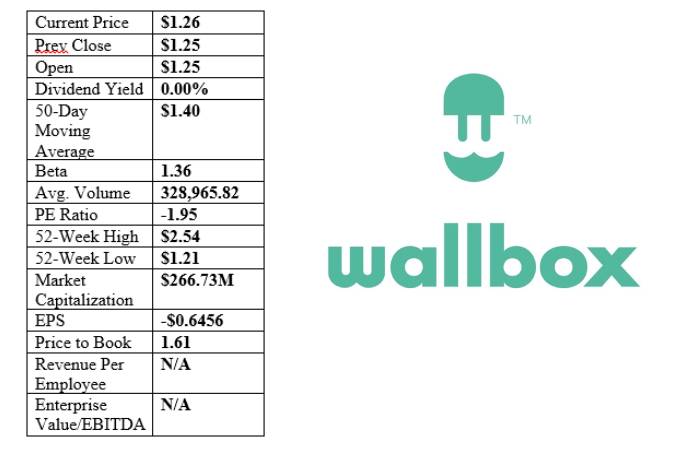

Wallbox NV (WBX) Statistics & Alternative Data 2024

Wallbox NV a global company, specialist on electric vehicle charging and energy management solutions. Its smart charging systems are equipped with cutting-edge technology and appealing design, therefore independently regulate the exchange of data between vehicle, grid, building and charger. Its founders are Enric Asuncion Escorsa and Eduard Castaneda and its based in Barna, Espana.

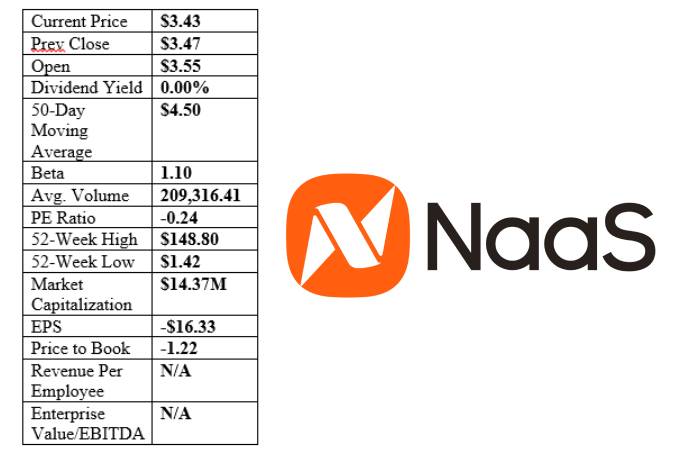

Naas Technology Inc (NAAS) Statistics & Alternative Data 2024

NaaS Technology, Inc. operates as an electric vehicle charging services company; Its results are based on its network of EV charging third-party charging station operators and the number of public DCFC (Direct Current Fast Charger 30kW or more) units that the firm is connected to in China. Cloud Capital Management was founded by Zhen Dai and Yang Wang on July 16, 2013 and is headquartered in Beijing, China.

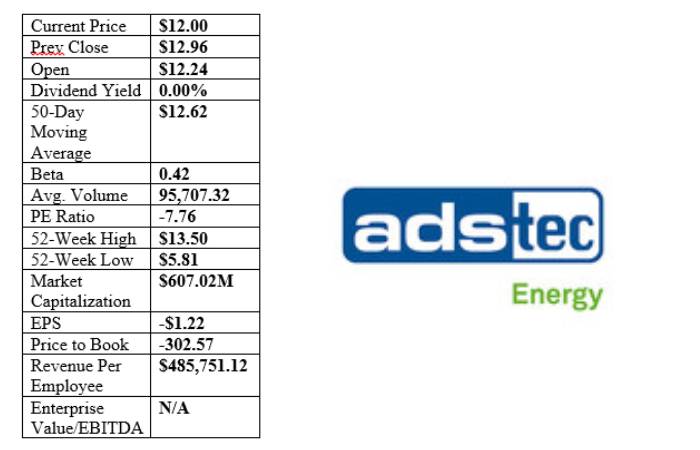

Ads-Tec Energy PLC (ADSE) Statistics & Alternative Data 2024

ADS-TEC Energy Plc works in the design, development and production of battery systems and technology platforms. He has studied lithium-ion technologies, storage solutions and fast-charging systems It was founded in 2021 and is headquartered in Dublin, Ireland.

Conclusion

Chpt stocktwits is one of the most relevant names in electric-vehicle charging, ChargePoint (CHPT), is flashin’ those noticeable signs and the buzz on StockTwits could offer valuable information for investors/traders.

Whether you are looking to trade short-term swings, or simply attempting to keep your finger on the long-term pulse of the EV space, paying attention to CHPT on StockTwits can yield some real time advice about how exact this company is hitting its marks. ChargePoint is well positioned to grow alongside the EV revolution, despite the risks of doing so.