“Is it worth the risk?” Is what people ask themselves in the most decisive moments of their lives.

However, investors are used to asking themselves this question every day to make a living.

It is no exaggeration in saying that any investment decision implies a certain degree of risk. Under such conditions, investors need to find a balance between the degree of risk and the prospect of income.

There are guidelines for investing in equities, rules, and guarantees for investing in real estate. However, what do we have for investing in digital assets?

Table of Contents

Digital Assets – Young And Promising

The digital world is diverse, so what exactly do we call an “asset” in this world? You deal with digital asset management if it has monetary value. Let’s take a closer look at it.

Digital Assets Are Young

The Internet began in 1983, and since then, it has been changing and evolving at an astonishing rate. People in business wouldn’t miss a chance to take advantage of this development. So now, we have the technological progress and entrepreneurial potential of humanity working together to create new formats of digital assets.

We can make a digital asset from a multitude of digital objects: photos, documents, or presentations. However, perhaps the most interesting in terms of monetization are sites. Not surprisingly, almost 380 of them are created every minute.

Generally speaking, digital assets remain young, as new formats and new ways of using them are continually being introduced, and there is no end in sight.

Also Read: Protecting Children’s Privacy a Comprehensive Guide

Hopefully, Digital Assets Are Promising

Websites as digital assets can enable entrepreneurs to create a source of passive income that will operate regardless of time zones, geographical location, and formal obligations.

However, what makes digital assets even more attractive to entrepreneurs and investors is the idea of virtually unlimited revenue potential.

There are several ways for investors to invest in a digital asset:

- To create a digital asset from scratch

- Order from a professional

- To buy a created asset

- Invest in an asset created and managed by someone else

Any of the above methods involve a degree of risk and complexity. You may be interested in expert advice on buying and selling websites.

The future of the digital world and, therefore, of digital assets is difficult to predict. However, it seems that over time, its impact and importance will increase. It means that today’s digital assets deserve more attention from investors.

Calling The Possible Dangers By Names

“Forewarned is armed,” they say. With investment risks, this saying works perfectly. To calculate and cover risks, investors first need to know what they’re facing. Therefore, it all starts with understanding the risks, at least those that are on the surface.

The Risk Not To Identify A Risk

We can’t help but deal with the digital world in our daily lives, and we may mistakenly believe that having superficial skills and knowledge is enough to understand how the online business works.

At the same time, internal rules and possible risks do require knowledge to be identified and interpreted.

In any business, there is a possibility that something unexpected will happen and situations will arise. In digital business, the chance to lose sight of the dangers ahead is doubly high, as digital entrepreneurship is a relatively young market, and many of its rules and regularities have yet to be discovered.

Jim Kramer, a TV presenter and businessman with experience, said that “from time to time the market does something so silly that it takes his breath away.” What we see so far is that the digital market can be unpredictable and can cause one to hold their breath quite often.

Vague Limits As A Two-Sided Coin

As previously mentioned, the digital market is young and constantly changing. Therefore, its rules and legal requirements are vague and incomplete. And in the “blind” part of the legislative system, there is room for both: creative ways of earning money and creative fraud.

It is believed that cybercrime is the most difficult to uncover and compensate through official institutions, as legislative instruments are often limited when it comes to innovative IT scams.

Unconscious legal violations can be another problem. The vaguer the rules, the easier it is to break them by accident. Therefore, you should seek advice on how to get the website to stay on the right side of the law.

No Long Lifespan Is Guaranteed

Unlike the life span of any property, digital assets are difficult to predict. Website survival depends on various factors, and some of them are hidden and unpredictable.

In case the site has some support, such as attachment to a strong global business, experts will be more confident and accurate in their forecasts.

However, when it comes to evaluating the life of the launch site, hardly any expectations will be convincing.

The unpredictable life of the source of income may also seem to be a severe problem for investors.

Digital World Is A Jungle

The online world is a wonderland for cheaters: with limited rules, they find unlimited space for cheating without being caught.

More than two-thirds of IT professionals are convinced that a successful cyberattack is inevitable in 2020. These and other statistics with some security tips you can see here.

Even with professional management, digital investors can lose money because of fraud, or they can overspend on security as online transactions with guarantees are sometimes overpriced.

Risks Are Worth Taking Managing

Taking a risk can sound romantic; however, it can lead to a strategy failure when making investment decisions. A successful investment strategy implies a risk management plan.

There are various ways to manage risk. Either take over everything or delegate part of the risk.

Take It All On You

As already mentioned, investors can do everything on their own: from creating a website to finding ways to monetize it.

A few risks can arise at any stage of the long road from creating a website from scratch to obtaining a source of income from it.

By not sharing the risks means that the investor is ready to take responsibility. It will be a wise investment choice if the investor is also a website management professional.

Professionals Only Or Sharing Risks

Knowledge is power, and at-risk it’s a weapon. Professional knowledge and experience in IT are almost vital to identify and calculate risks, and then to create a defensive strategy or find ways to cover them.

You can look at some basic ideas for risk management. However, superficial knowledge is hardly enough to assess and avoid risks when investing in digital assets.

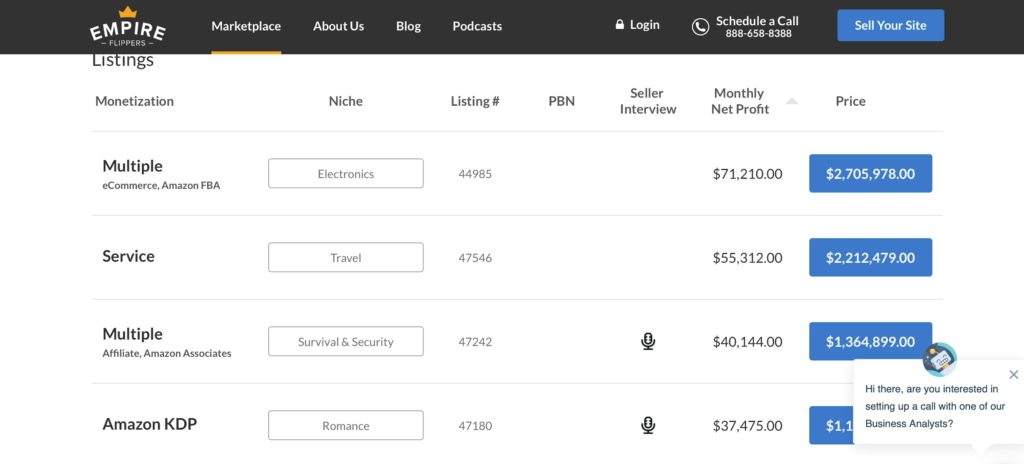

You can order an asset from a professional or buy it on a platform such as Empire Flippers.

As shown in the picture, sites offered on platforms already guarantee some level of income. The only remaining risks will be hidden in the management of the finished website.

However, specialized agencies and freelancers also offer their website management services. In this way, investors can delegate some of the risks in exchange for the money paid.

TikTak Global As An Example Of Investors’ Safe Place

As the world-famous investor Warren Buffett said, “The risk comes from not knowing what you’re doing.” It means that the secret of reducing risk to a minimum when investing in digital assets can be hidden in the in-depth knowledge and experience in this area.

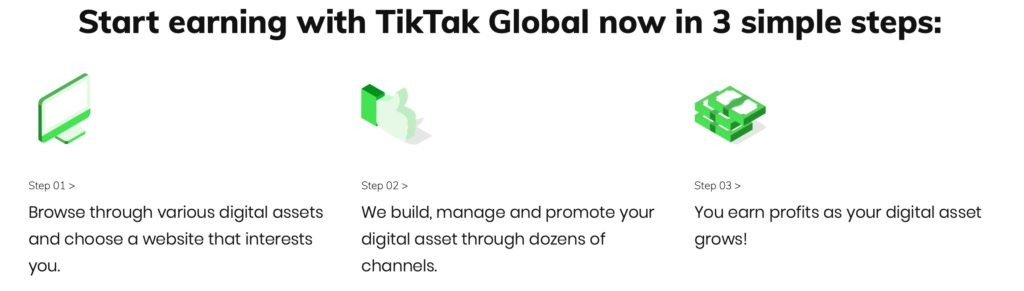

There are companies like TikTak Global that offer investors to buy a “piece” of a digital asset. The assets they offer already exist and are functioning. The assets that investors can choose at their discretion are managed by a professional team that takes on all possible risks and issues.

For investors, the process is quite simple – it involves three steps, where the third one is earning. The way the company presents it is shown below.

The company’s experts provide investors with all the information they may need to ensure that an investment solution is safe and truly worth it. You may get the consultation online and start your partnership with TikTak Global through the website.

When professionals manage the asset, the rate of return is likely to be high. Thus, the balance of the “risk profit” of a digital asset can be attractive to investors who entrust part of the management to professionals.

However, specialized agencies and freelancers also offer their website management services. Thus, investors may decide to delegate some risks in exchange for the money paid.

Summing Up – To Risk Or Not To Risk

There is no precise universal guidance for investors on how to identify the risks that are worth taking. Each case is unique and requires time and expertise to assess the probability of risk and the prospects for profit.

Investing in digital assets is rightfully considered risky. However, it should also be called promising. We have seen the risks and called them by their names.

We have also seen examples of websites that bring billions to their owners, and this shows that a professional approach works wonders.